Economy

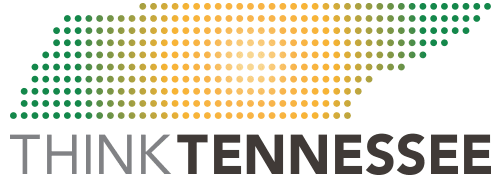

PAID FAMILY LEAVE FLEXIBILITY: GOOD FOR TENNESSEE’S FAMILIES AND THE STATE (2025)

In 2023, the Tennessee legislature established a six-week paid family leave program for most state employees and educators for the birth of a child or adoption placement. This year, the legislature is considering allowing this paid leave to be used for foster placement and caregiving of parents and close family members. Our fact sheet demonstrates how expanding the current paid leave program would keep state employees from having to choose between these critical roles and their economic stability. It would also help the State retain their trained, experienced workforce and reduce hiring costs, benefiting all Tennessee taxpayers.

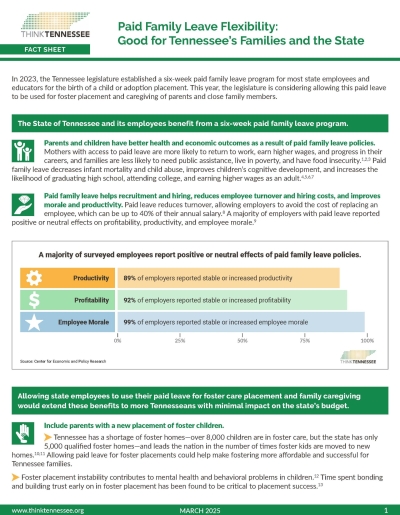

LET’S GET TO WORK: STUDENT SUPPORTS WILL HELP TENNESSEE TRAIN THE WORKFORCE IT NEEDS (2025)

Tennessee needs more middle-skill workers, but attaining an associate degree or technical certificate is a challenge for many Tennesseans. Our policy brief, created in collaboration with Tennessee Skills Coalition, includes data on the state’s worker shortage, cost of program attendance, and the impact of post-secondary education on employment and earnings. The report also provides recommendations to improve the state’s preeminent scholarship programs, Tennessee Promise and Tennessee Reconnect, through policy modifications that would increase funding levels and flexibility.

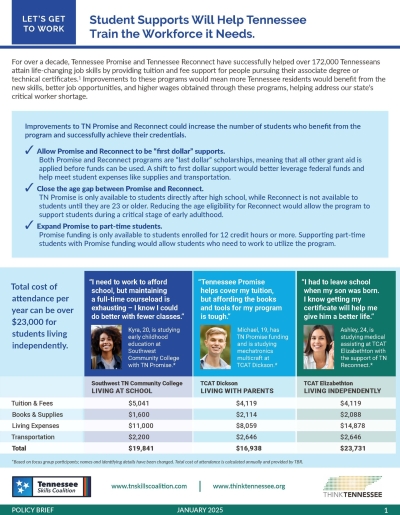

THE EARLY YEARS: INVESTING IN CHILDCARE WILL HELP FAMILIES AND OUR ECONOMY (2025)

Tennessee families are struggling to access affordable childcare, and providers are straining to manage their costs and pay their workforce living wages. Rooted in an analysis of best practices from other states, this policy brief expands on the childcare policy discourse in Tennessee, providing an overview of the economic impact of affordable childcare access, childcare workforce challenges and opportunities, and new recommendations to increase childcare capacity and labor force participation in the state.

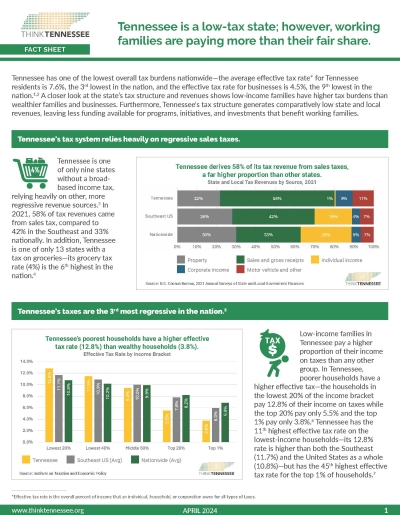

TENNESSEE IS A LOW-TAX STATE; HOWEVER, WORKING FAMILIES ARE PAYING MORE THAN THEIR FAIR SHARE (2024)

In our new analysis, we found that while Tennessee has one of the lowest overall tax burdens in the nation, its low-income families face a higher effective tax rate than both wealthier families and businesses.

Using data from The Tax Foundation, Ernst & Young, Economic Policy Institute, and U.S. Census Bureau, among others, ThinkTennessee analyzed tax revenue sources, effective tax rates by income level, and local expenditures in Tennessee. The analysis showed that the state’s tax system relies heavily on regressive taxes, resulting in Tennessee’s poorest households paying the highest proportion of their income in taxes relative to middle- and high-income earners. Furthermore, Tennessee’s tax structure generates comparatively low state and local revenues, leading to less funding available for programs, initiatives, and investments that benefit working families.

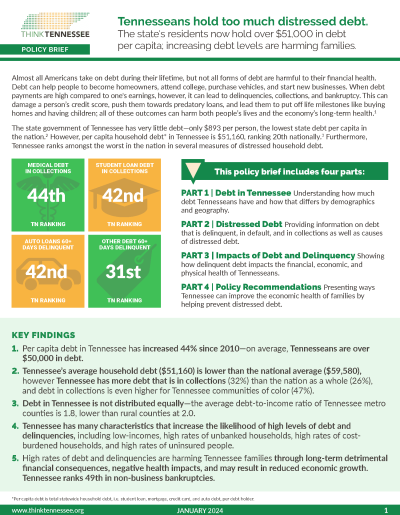

TENNESSEANS HOLD TOO MUCH DISTRESSED DEBT (2024)

Debt in Tennessee has increased 44% since 2010, compared to 26% nationally — on average, Tennessee households are over $50,000 in debt. Tennessee has many characteristics that increase the likelihood of high levels of debt and delinquencies, including low incomes, high rates of unbanked households, high rates of cost-burdened households, and high rates of uninsured people.

High rates of debt and delinquencies harm Tennessee families through long-term financial consequences, negative health impacts, and may result in reduced economic growth. Our new policy brief details the harmful effects of high levels of debt and provides policy recommendations for ways Tennessee can improve the economic health of families.

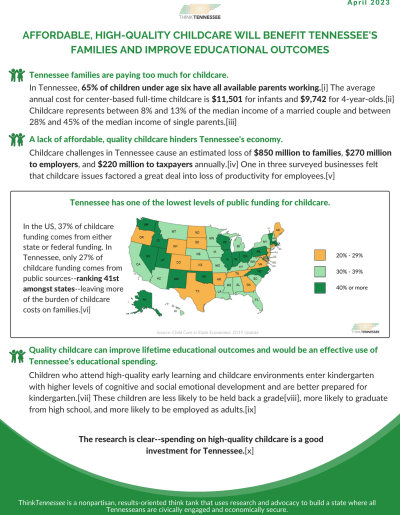

AFFORDABLE, HIGH-QUALITY CHILDCARE WILL BENEFIT TENNESSEE’S FAMILIES AND IMPROVE EDUCATIONAL OUTCOMES (2023)

In Tennessee, only 27% of childcare funding comes from public sources, which leaves more of the burden of childcare costs on families.

This fact sheet describes how increasing the state’s investment in high-quality childcare supports Tennessee working families, employers, and the Tennessee economy.

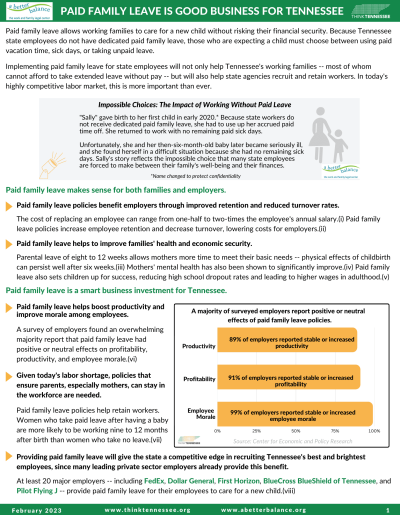

PAID FAMILY LEAVE IS GOOD BUSINESS FOR TENNESSEE (2023)

Tennessee state employees do not currently have dedicated paid family leave; instead, those who are expecting a child must decide between using paid vacation time, sick days, or taking unpaid leave. The potential loss of income creates a financial hardship for many working families and could be keeping many out of the workforce entirely.

This brief explains how implementing a paid family leave policy for state employees is fiscally responsible and benefits workers, taxpayers, and employers.

Our brief provides a summary of our key findings and recommendations. For more detail, please see our full report here.

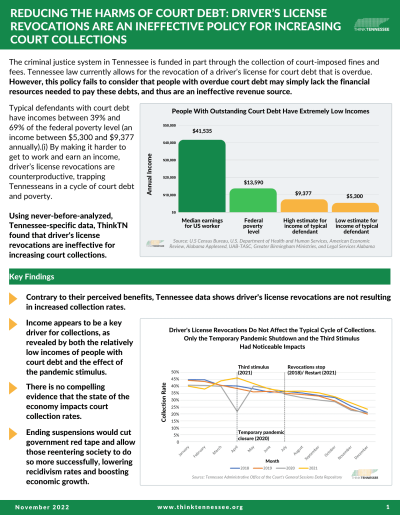

Reducing the Harms of Court Debt: Driver’s License Revocations are an Ineffective Policy for Increasing Court Collections (2022)

Tennessee law currently allows for the revocation of a driver’s license for court debt that is overdue.

This brief evaluates the impact of driver’s license revocations and finds no meaningful effect on court debt collection rates in Tennessee. It also provides policy options for systemic reform, including the elimination of driver’s license revocations, increased consistency in the ability-to-pay determination process, and implementation of either targeted or broad fee elimination.

Our brief provides a summary of our key findings and recommendations. For more detail, please see our full report here.

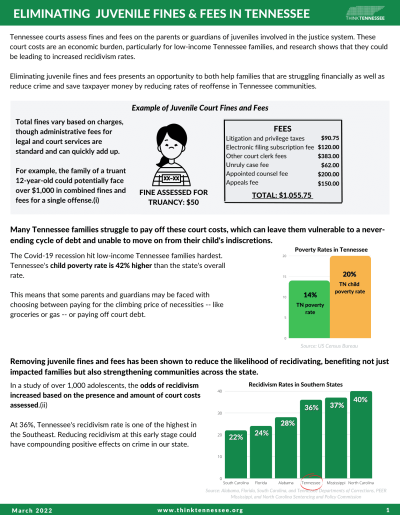

Eliminating Juvenile Fines & Fees in Tennessee (2022)

Tennessee courts assess fines and fees on the parents or guardians of juveniles involved in the justice system. These court costs are an economic burden, particularly for low-income Tennessee families, and research shows that they could be leading to increased recidivism rates.

This brief describes the inequitable impact of juvenile fines and fees and underscores how their elimination would help Tennessee families and save taxpayer dollars by reducing recidivism rates in Tennessee communities.

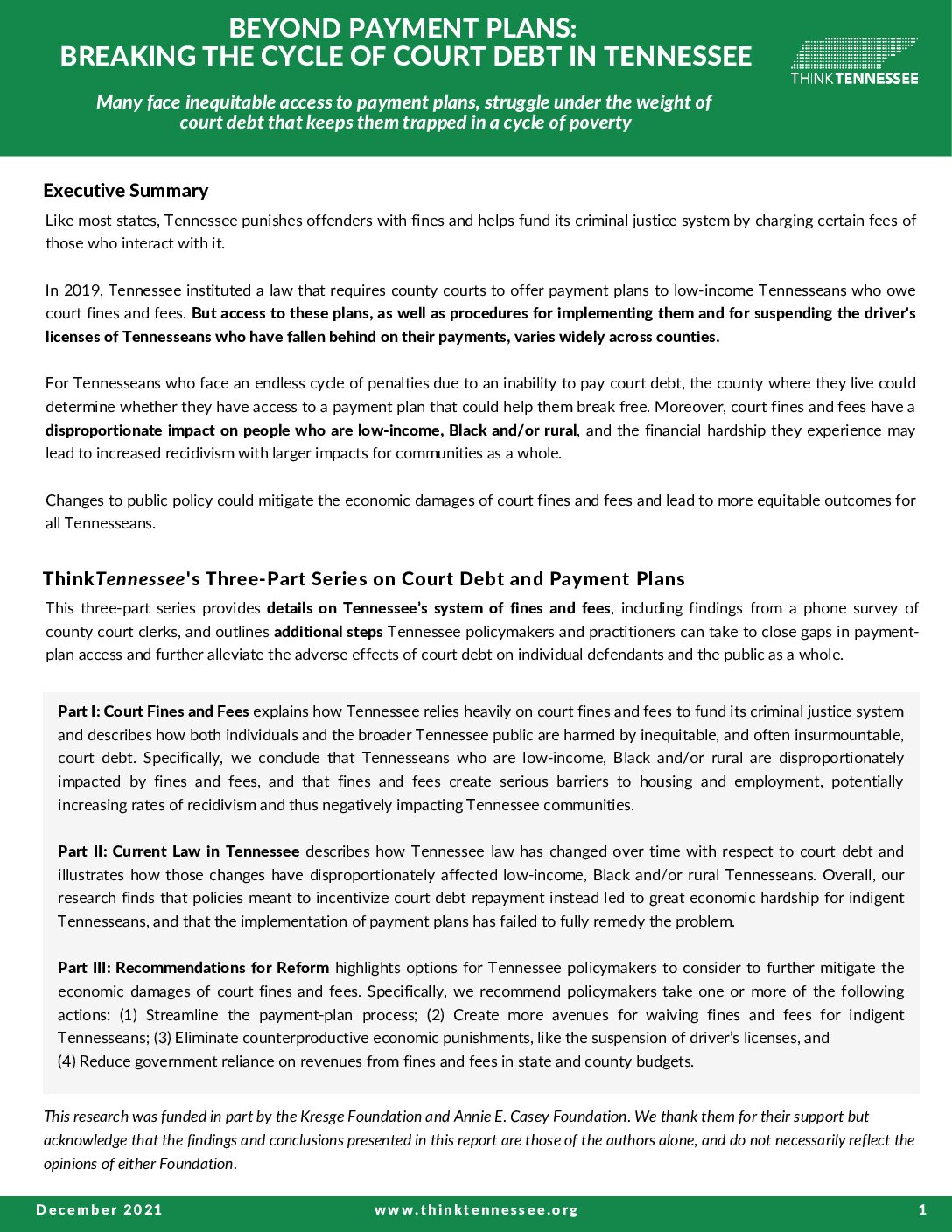

BEYOND PAYMENT PLANS: BREAKING THE CYCLE OF COURT DEBT IN TENNESSEE

In 2019, Tennessee instituted a law that requires county courts to offer payment plans to low-income Tennesseans who owe court fines and fees. But access to these plans, as well as procedures for implementing them and for suspending the driver’s licenses of Tennesseans who have fallen behind on their payments, varies widely across counties.

This three-part series provides details on Tennessee’s system of fines and fees, including findings from a phone survey of county court clerks, and outlines additional steps Tennessee policymakers and practitioners can take to close gaps in payment-plan access and further alleviate the adverse effects of court debt on individual defendants and the public as a whole.

SURVEY FINDS MANY TENNESSEANS LACK FINANCIAL SECURITY, MOST SUPPORT MEDICAL, STUDENT AND COURT DEBT POLICY REFORM

This memo outlines key findings from an online survey conducted from February 3 to 11, 2021 by Hart Research Associates on behalf of ThinkTennessee of 504 Tennesseans who are registered voters. It finds seven in ten Tennessee voters (72%) are concerned about the high rate of Tennesseans with debt in collections, and a majority support reforms that would reduce government penalties on those in financial distress.

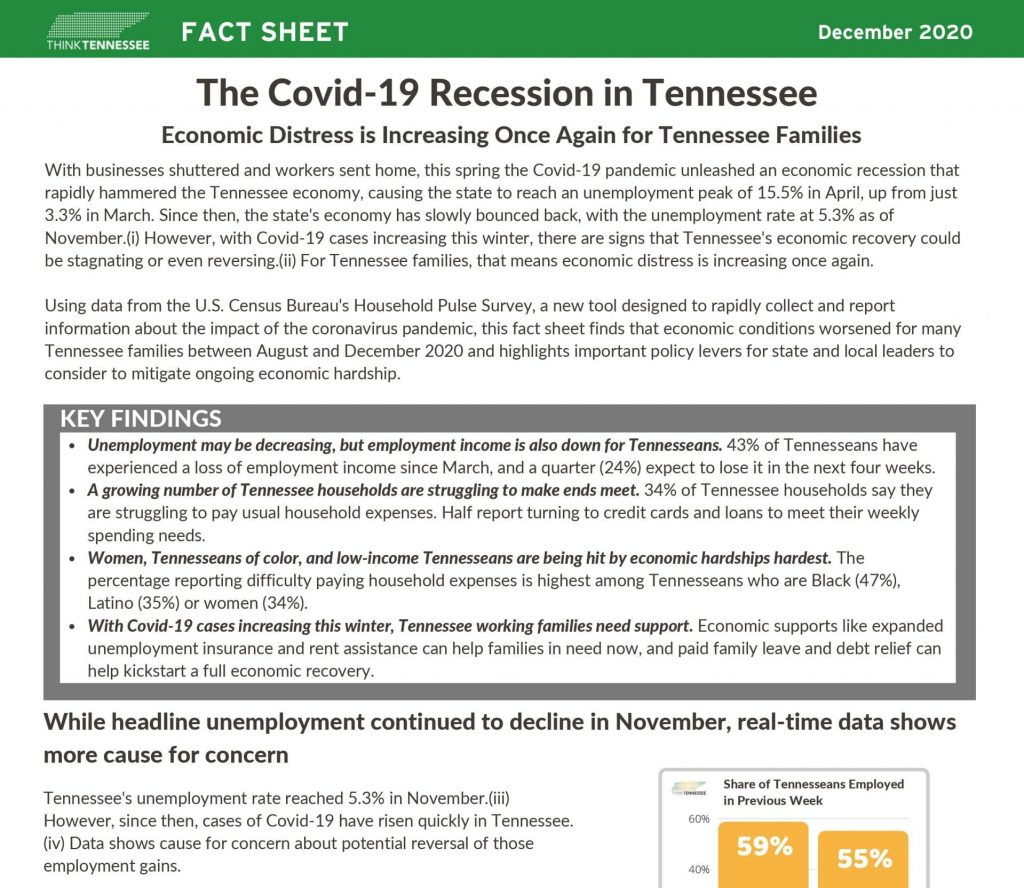

THE COVID-19 RECESSION IN TENNESSEE FACT SHEET

This fact sheet analyzes data from the U.S. Census Bureau’s Household Pulse Survey, a new tool designed to collect information about how lives have been impacted by the coronavirus pandemic, highlighting both the latest economic conditions for Tennessee’s working families and important policy levers for state and local leaders to consider to mitigate ongoing economic distress.

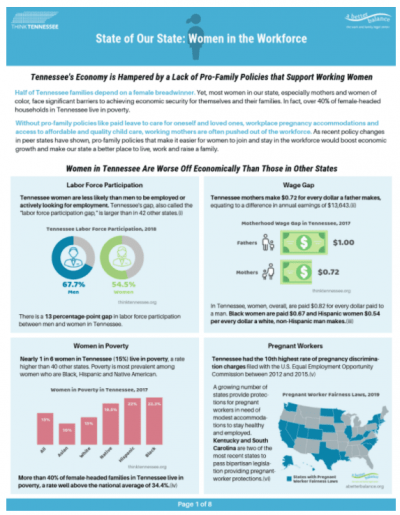

State of Our State: Women in the Workforce (2019)

Developed in partnership with the A Better Balance, this policy brief addresses the state of working women in Tennessee. It finds that half of Tennessee families depend on a female breadwinner. Yet, most women in our state face significant barriers to achieving economic security for themselves and their families.

The brief highlights pro-family policies that would make it easier for women to join and stay in the workforce, boosting economic growth and making our state a better place to live, work and raise a family.

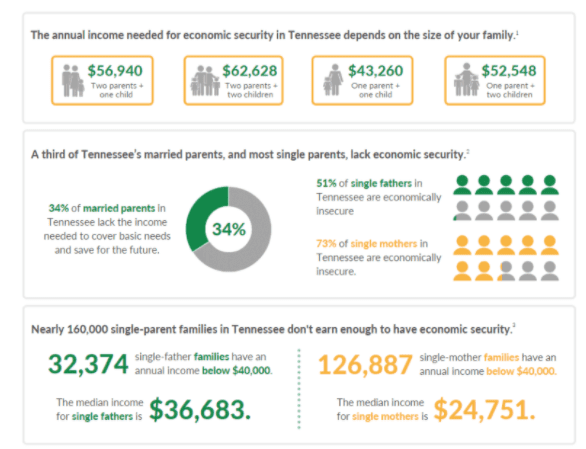

Working Families and Economic Security Fact Sheet (2019)

Too many working families in Tennessee lack economic security.

Parenting is demanding—physically, emotionally and financially. But just how much does providing for a family in Tennessee cost? Are families in our state able to afford it? This Working Parents Day, we’re taking a closer look.