This year, Nashville could see its first major attempt at a mass transit overhaul since the failed 2018 transit referendum. Throughout his campaign and from his first day in office, Mayor Freddie O’Connell has made clear his priority to improve the city’s transportation system. Transportation was a focus of his transition team with the “How Nashville Moves” Committee (of which ThinkTennessee’s president Erin Hafkenschiel was a member), and based on a recommendation by that committee to consider high-turnout elections, he may soon announce his intention to pursue a transit referendum during the general election this November. The process for getting a transit referendum on the ballot is enabled by and defined in the IMPROVE Act. The IMPROVE Act, which was signed into law on April 26, 2017, allows local governments an option to generate new revenue specifically for public transit programs after a local referendum, but a series of steps must be taken to get a Transit Improvement Program (TIP) on the ballot.

KEY TAKEAWAYS:

- Revenue Sources: The IMPROVE Act allows select cities and counties to raise sales tax an additional 2.75% beyond the existing cap. A half-cent increase in sales tax in Davidson County is estimated to generate approximately $162 million in 2024 (Source: FY 2024 Budget Ordinance of Metro Nashville-Davidson Co.). The hotel/motel surcharge cannot exceed a total of 20% of all relevant taxes & surcharges. With the 1% increase for the Titans Stadium, Davidson County’s hotel occupancy rate is now 7%, plus a $2.50 nightly fee (combined with state sales tax for a total rate of 16.25%). A 1% increase for transit would likely generate between $18 to $25 million per year (Source: FY 2024 Budget Book, page 476).

- Types of Infrastructure: While the IMPROVE Act limits the dedicated funding revenues for transit projects, it does allow for revenue sources to fund supporting infrastructure to “provide connectivity for the transportation facility”, which could likely include sidewalks, bike lanes, and greenways within a half-mile of transit improvements.

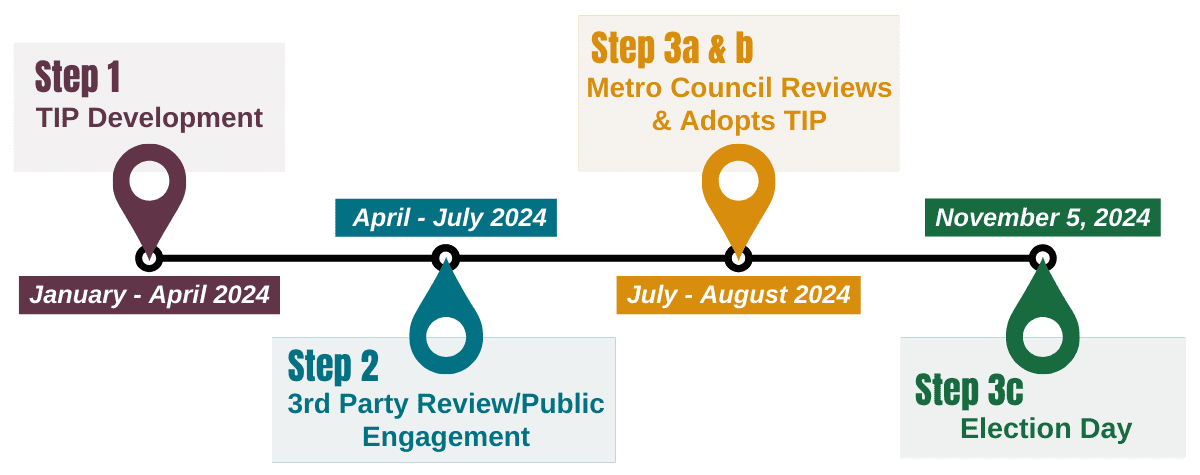

- Timeline: While the IMPROVE Act includes specific steps for putting a referendum on the ballot, (including developing the TIP, a third-party review, and Metro Council review and adoption), it is possible to complete these steps in the next 10 months.

EXAMPLE TIMELINE:

HOW DOES THE IMPROVE ACT AFFECT TRANSIT?

Tennessee’s 2017 IMPROVE Act increased the state’s gas tax from 20 cents to 26 cents to help fund over 960 road and bridge projects identified by law. No transit projects were identified in this list, instead opening the door for local governments to take the lead on transit investments. The legislation authorizes cities and counties of a certain size (counties with populations over 112,000 and cities with populations over 165,000) to raise dedicated funds for transit through a voter referendum.

WHERE DOES THE FUNDING COME FROM?

The IMPROVE Act defines six possible surcharges that can be considered in a transit funding referendum, and only if that local government is already collecting that tax. (Note that certain limits are imposed on the maximum surcharge rates.)

- Local option sales tax surcharge, not exceeding 2.75%.

- Hotel/Motel surcharge, not exceeding a 20% aggregate of relevant taxes & surcharges.

- Business privilege tax surcharge, not exceeding 20% of the current rate.

- Residential development fee surcharge, not exceeding 20% of the current rate.

- Local car rental tax surcharge, not exceeding 20% of the current rate.

- Motor vehicle/wheel tax surcharge, the total sum of both the tax and surcharge not exceeding $200.

WHAT CAN THE FUNDS BE USED FOR?

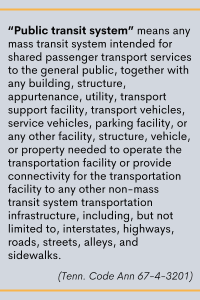

Funding generated from surcharges authorized by the referendum must be utilized for purposes outlined in a Transit Improvement Program, or TIP. This can include funding the planning, engineering, development, construction, implementation, administration, management, operation, and maintenance of public transit projects.

The IMPROVE Act’s definition of eligible “public transit systems” includes the transit system, any supporting buildings, facilities, or infrastructure needed to operate the transportation facility or provide connectivity for the transportation facility, including roads, streets, and sidewalks.

The IMPROVE Act’s definition of eligible “public transit systems” includes the transit system, any supporting buildings, facilities, or infrastructure needed to operate the transportation facility or provide connectivity for the transportation facility, including roads, streets, and sidewalks.

State law requires the TIP to include:

- The type and rate of a surcharge

- The date a surcharge will end, or the conditions upon which the surcharge will be terminated or reduced

- Any other sources of funding for the program

- An estimate of the initial and recurring cost of the program

- The implementing agencies responsible for carrying out the program

- The geographic location of the public transit system projects

The TIP must include a financing plan considering its financial feasibility, which should include anticipated costs, risks, and liabilities, the anticipated revenue generated by the surcharge and TIP, and the local government’s overall financial position. Any projects within the TIP financed through bonds or other debt must also be identified. This financing plan must be audited by a third-party public accounting firm approved by the state comptroller.

HOW DOES A TRANSIT REFERENDUM GET TO THE BALLOT?

Once the third-party analysis is completed, the TIP will need to be adopted by the county or city’s legislative body through ordinance or resolution. In Nashville’s case, the TIP, including both the list of projects and the proposed revenue sources, must be approved by the Metro Council.

State law requires that the resolution proposing the referendum contain a brief summary of the TIP for which the surcharge revenue will be used. The summary must describe the public transit system projects and services to be funded and implemented, as well as the specific considerations outlined in bulleted form above.

Once the local legislative body approves the TIP and its associated revenue sources, the county election commission schedules the referendum for an upcoming election. The county election commission is also required to send a copy of the approved ordinance or resolution to the Tennessee Department of Revenue prior to the election.

Voters will then have the option to vote FOR or AGAINST the measure, requiring a simple majority. If the measure is approved by voters, the county election commission is also required to send a new copy of the approved ordinance or resolution to the Tennessee Department of Revenue after the referendum.

IMPROVE ACT TIMELINE

The timeframes included here are approximate estimates of the same steps taken during the 2018 Nashville referendum.

STEP 1 – Develop the Transit Improvement Program (TIP) – 3-6 months

- Local planning, engineering, and financial staff begin to put together the TIP, outlining proposed transit projects, services, and a financing plan estimating financial feasibility.

- Host open public comment periods on the draft TIP, incorporating relevant public feedback on the proposed plan.

- Make reasonable efforts to notify or coordinate with other nearby local governments.

STEP 2 – Identify a Public Accounting Firm to Audit the TIP – 3-4 months

- Once the TIP has been drafted, submit a proposal identifying the selected public accounting firm and the auditing procedures used by the firm to the state comptroller of the treasury for approval.

- The state comptroller approves the selection of the firm and the procedures to be used.

- The third-party public accounting firm reviews the TIP’s financing plan, providing an opinion whether the assumptions made in the TIP’s financing plan are reasonable and that the proposed TIP is financially feasible.

- Once the financial feasibility determination or opinion is completed, the local government is required to post both it and the financing plan in its entirety on their website.

STEP 3 – City or County Legislative Body Reviews and Adopts TIP – 2 months

- City council or county commission drafts and debates ordinance or resolution adopting the TIP and the requisite referendum ballot language. A simple majority of the city council or county commission is required for adoption.

- If the TIP ordinance or resolution is adopted by the local legislative body, the county election commission schedules the referendum for the next general election. A copy of the proposed ordinance or resolution is submitted to the state Department of Revenue both prior to the election as well as after the referendum passes.

- Voters decide whether they approve (“FOR”) or reject (“AGAINST”) the proposed tax levy.

STEP 4 – Begin tax collection on the first day of a month at least sixty days after the date of the election in which the referendum was approved.