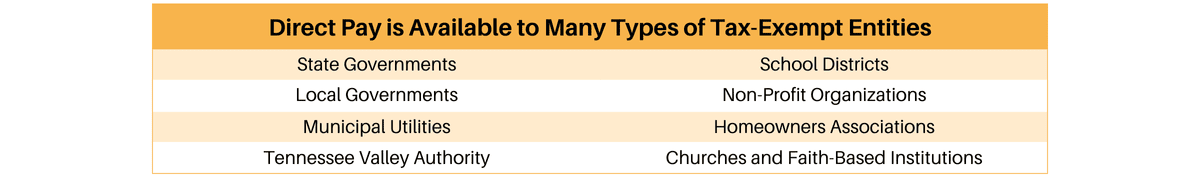

The Inflation Reduction Act (IRA)—a landmark federal law enacted in 2022— included over $780 billion to support clean energy projects, reduce the country’s greenhouse gas emissions, and address the impacts of climate change. The bill expanded clean energy tax credits which have long been a powerful tool to encourage private companies to invest in new technology or invest in their communities. Local governments and nonprofits have historically not been able to take advantage of tax credits, however the IRA establishes a new program, Direct Pay, which allows tax-exempt entities the opportunity to utilize tax credits in support of local infrastructure projects.

Direct Pay gives tax-exempt entities access to $280 billion in tax credits to be used for funding for local projects.

Direct Pay, also referred to as Elective Pay, is a new type of funding created by the IRA. For the first time, tax-exempt entities can take advantage of clean energy tax credits by getting a direct cash payment for the value of the credits from the IRS. With no competitive application process, no limits on the total funding available, and no post-credit report requirements, this program provides a substantial new opportunity for tax-exempt organizations, giving them access to the tax credits which account for 70% of the $400 billion in climate and infrastructure funding provided by the IRA.

Direct Pay can help fund a wide range of infrastructure projects.

There are 12 tax credits that are newly accessible through Direct Pay, covering a broad range of clean energy and renewable projects. These include both construction of clean energy infrastructure and purchases of clean energy technologies. Uses of Direct Pay clean energy tax credits for production include solar roof installations for government-owned buildings, construction of wind farms, and geothermal construction. Areas eligible for these credits also include construction of electric vehicle charging infrastructure as well as purchases of electric vehicles.

There are 12 tax credits that are newly accessible through Direct Pay, covering a broad range of clean energy and renewable projects. These include both construction of clean energy infrastructure and purchases of clean energy technologies. Uses of Direct Pay clean energy tax credits for production include solar roof installations for government-owned buildings, construction of wind farms, and geothermal construction. Areas eligible for these credits also include construction of electric vehicle charging infrastructure as well as purchases of electric vehicles.

Direct Pay will fund infrastructure projects with long–term community benefits.

Eligible clean energy projects offer many benefits to local communities. For example, transitioning to electric school bus fleets and building the necessary charging infrastructure will allow school districts to replace aging and polluting internal-combustion engine school buses. Idling school buses are a major source of air pollution and increase the occurrence of asthma and respiratory illness in young children. Electric school buses will create a more fuel-efficient transportation system that reduces the emissions that causes respiratory illness. Wind farms in rural communities provide long-term, stable income for workers in their communities. And solar roof installations on public housing can lower the cost of energy for low-income residents.

Direct Pay provides funding flexibility.

Direct Pay provides funding flexibility.

To access direct pay, eligible entities file a tax form detailing their projects. The IRS will then treat the applicable tax credits as an overpayment of taxes and will refund this ‘overpayment’ to the entity, resulting in a direct cash payment equal to the value of the tax credit. These tax credits provide significant flexibility to tax-exempt entities, since there is no competitive application process and the credits come in the form of direct payments. Direct Pay tax credits can be leveraged for projects as small as a single vehicle purchase and as big as the construction of a wind farm. Direct Pay provides a flexible timeline, too; it can be used for projects that are currently underway as well as future projects.

Direct Pay is an example of an innovative and flexible way to support and incentivize clean energy infrastructure projects in more communities. Tax credits are a proven mechanism to drive the market towards technological adoption and can now be utilized by tax-exempt entities. Direct Pay will allow communities to invest in new technology and cleaner infrastructure that will lower energy costs, improve the air quality, and reduce respiratory illnesses in our most vulnerable populations.

To learn more about Direct Pay, please see below for additional helpful links and resources:

- Center for American Progress: Overview of Direct Pay: An article outlining the ways Direct Pay creates new opportunities for funding.

- National League of Cities: Guide to Filing for Direct Pay: A step-by-step guide to the IRS filing process that allows entities to receive money from Direct Pay.

- Lawyers for Good Government: Compilation of Direct Pay Resources: A compilation of resources for entities looking to use Direct Pay, including legal questions & answers, tax filing guidance, and fact sheets for eligible projects.

- Lawyers for Good Government: Clean Energy Tax Navigator: An interactive website that allows users to receive assistance on direct pay tax credits for potential, planned, or completed projects.

- IRS: Frequently Asked Questions: The IRS’s guide to complying with Direct Pay’s regulations.

Special thanks to Jamie Watson for his research and writing contributions to this article.